A Shift Too Big to Ignore

What if a single statistic — a 10.9% drop in China’s semiconductor imports — is not just about trade, but a signal of an unfolding global transformation in technology, economy, and geopolitics?

At first glance, it might seem like a minor market fluctuation or the result of a temporary supply chain correction. But as we dig deeper, the data uncovers a strategic realignment with global consequences.

This blog explores why China’s reduced chip imports may actually represent a calculated move toward global tech leadership, how it’s connected to their long-term semiconductor ambitions, and what the rest of the world should prepare for. We’ll also unpack China’s three-pronged strategy that could make today’s chip manufacturing technologies obsolete.

📉 The Data That Sparked Global Attention

Let’s begin with the shocking statistic:

China’s semiconductor imports fell 10.9% year-over-year, as reported by recent Chinese customs data.

This figure caught the attention of Wall Street, Silicon Valley, and tech policy think tanks across the globe. For context, China has long been the world’s largest semiconductor importer, spending hundreds of billions of dollars annually on chips for everything from smartphones and laptops to electric vehicles and military equipment.

So a near 11% reduction isn’t just an economic ripple—it’s a geopolitical tremor.

🧠 So far, what have we learned?

It’s not just that China is buying fewer chips. The real question is why. And the answer may not be what it seems.

Let’s explore the deeper layers.

🇨🇳 What’s Actually Happening? The Shift to Domestic Power

1. The Made in China 2025 Strategy

China has been pursuing semiconductor self-sufficiency as a core pillar of its long-term strategy through its Made in China 2025 initiative. This isn’t new—it’s been years in the making. But now, we’re beginning to see the effects materialize in real numbers.

- China has invested hundreds of billions of dollars in:

- Building local chip fabrication facilities (fabs)

- Funding R&D for advanced chip architectures

- Incentivizing domestic firms like SMIC and Huawei HiSilicon

What makes this different from earlier attempts? This time, they’re not just catching up—they’re starting to leapfrog.

2. Strategic Stockpiling of Chips

One often-overlooked angle is that China has been stockpiling semiconductors for years. Reports suggest the government and private corporations have built reserves in anticipation of supply chain disruptions and trade tensions.

The current decline in imports may reflect that China’s chip reserves have reached a critical mass—not that they suddenly need fewer chips.

This strategy mirrors how countries treat oil or rare earth minerals: as national security assets.

3. Homegrown Tech Is Surpassing Expectations

China’s domestic chip sector is no longer just about mid-range chips for appliances or low-power devices.

Recent breakthroughs include:

- AI-focused processors for machine learning

- Quantum computing chips

- Specialized photonic and neuromorphic processors

Chinese firms are also making progress on 7nm and 5nm manufacturing nodes, previously thought unreachable due to export restrictions.

🔍 So far, we’ve seen a pattern. But let’s dive deeper…

This isn’t just a response to sanctions. It’s a carefully engineered three-phase transformation of China’s semiconductor ecosystem.

🔺 The Three-Pronged Strategy: China’s Hidden Playbook

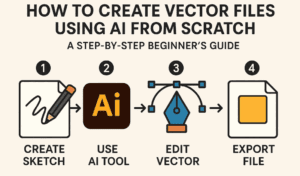

China isn’t just making chips. They’re trying to redefine what chips are and how they’re made. Here’s how:

🔧 Phase 1: Rapid Domestic Manufacturing Expansion

China has launched dozens of new semiconductor fabrication plants (fabs) across various provinces, many backed by state funding.

Key highlights:

- Advanced cleanroom facilities

- AI-optimized chip design pipelines

- Subsidized supply chains for materials and equipment

What’s surprising is not just the number of fabs—but their sophistication and production targets, which rival global leaders like TSMC.

👨💼 Phase 2: Aggressive Global Talent Recruitment

China has been quietly attracting top chip talent from leading companies around the world.

- Former engineers and executives from Intel, Samsung, and TSMC have reportedly joined Chinese firms.

- They bring with them decades of proprietary knowledge and process expertise.

China isn’t just building factories—it’s importing intellectual capital.

🧪 Phase 3: Redefining Semiconductor Technology

This is where the game changes completely.

China is investing heavily in next-gen chip technologies that could replace silicon altogether.

Emerging areas include:

- Photonic chips (light-based processing for ultra-high-speed computing)

- Bio-integrated circuits (chips that interact with biological systems)

- Quantum processors (for encryption and scientific simulation)

If successful, these technologies would render traditional chip-making methods obsolete and shift the center of tech gravity to Beijing.

🛰️ Evidence from the Ground: Leaks and Satellite Imagery

According to reports:

- Satellite imagery shows unmarked research facilities that insiders claim are pilot sites for non-silicon-based chip manufacturing.

- These “labs” are producing prototypes of revolutionary chips using proprietary Chinese technologies.

- Leaked documents reveal an 18-month timeline for global market rollout.

🌍 Implications for the Global Tech Landscape

Let’s step back and consider what all this means for the world.

💣 1. A Technological Power Shift

If China succeeds in commercializing these next-gen chips, it won’t just catch up—it will lead.

Western semiconductor giants like Intel, AMD, and Qualcomm could find themselves undercut on cost and outperformed in capability.

📉 2. Economic Disruptions and Market Shock

Stock markets may react swiftly once these technologies hit the global market:

- Investors will reassess valuations of current chipmakers

- Economies heavily reliant on chip exports may see trade imbalances

- Governments may scramble to secure access to the new supply chain

🧭 3. Global Tech Fragmentation

Rather than a unified global tech standard, we may see:

- A China-led chip ecosystem using its own standards

- A Western-led ecosystem protected by alliances like CHIPS Act policies

- A race for raw materials and tooling equipment

❓ Q&A: The Questions Everyone’s Asking

Q1: Is China really capable of surpassing the West in chip technology?

It’s no longer a matter of if, but when. With enough investment, talent, and strategic focus, China is already building the infrastructure and IP base to surpass conventional silicon technologies.

Q2: Will the U.S. and allies respond?

Yes. The CHIPS and Science Act, export controls on ASML lithography machines, and alliance-building with Japan and Korea are part of the West’s response. But the pace of China’s innovation may outstrip these efforts.

Q3: What industries are most at risk?

- Smartphone and computing

- Defense and aerospace

- AI and cloud computing

- Automotive (EV chips)

Any sector relying on high-performance chips could feel the impact first.

📣 Final Thoughts: This Isn’t About Chips — It’s About Power

China’s 10.9% decline in chip imports may look like a statistic.

But it’s actually a strategic inflection point in the race for global technological dominance.

While the world debates economic indicators, China is building the future of computing—quietly, methodically, and relentlessly. If their plan succeeds, we may be entering an era where Beijing sets the pace for tech innovation, not Silicon Valley.

🔖 Tags:

china chip imports, china semiconductor strategy, made in china 2025, photonic chips, quantum processors, global chip war, china vs usa technology, semiconductor future, china chip independence, supply chain disruption

📢 Hashtags:

#ChinaTech #SemiconductorWar #ChipImports #MadeInChina2025 #QuantumChips #PhotonicProcessors #TechGeopolitics #ChinaVsUSA #SemiconductorNews #GlobalTechShift

Disclaimer:

This article is based on publicly available data, industry reports, and intelligence leaks. The exact timeline and accuracy of China’s emerging technologies cannot be independently verified at this time. This content is intended for educational and analytical purposes only.